Credit Score Rankings, Explanations, and an Infographic

Note: We may embed some sponsored links that can earn us a commission to defray operating costs for this website.

Note: We may embed some sponsored links that can earn us a commission to defray operating costs for this website. Credit Score Rankings Explained

Certainly, you’ve heard people mention a bad credit score or a good credit score; however, you may not know what these actually mean. Even more, you may not know how you should classify your own credit score. Most of all, you might not understand how landlords, lenders, utility companies, or even insurers will view your credit score’s rank. How does a 640, 710, or 800 credit score actually impact your personal finances?

The Credit Score Rankings Infographic

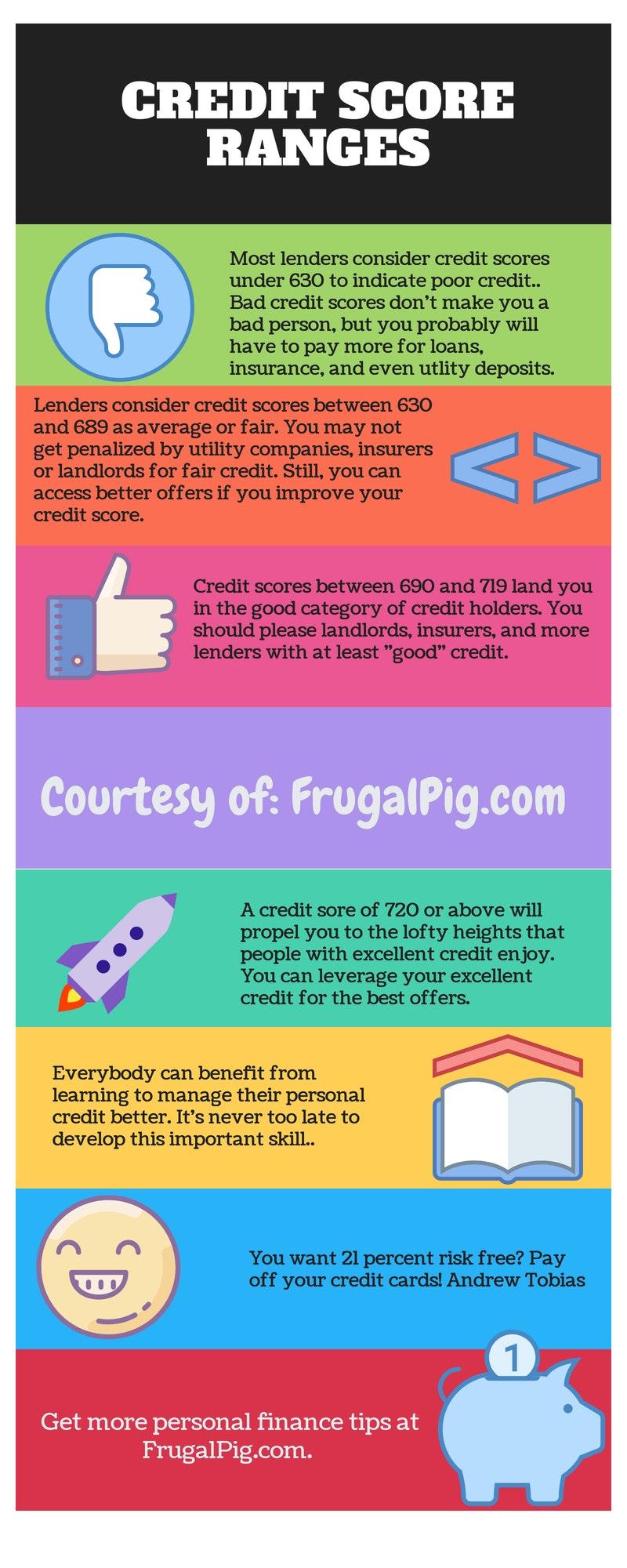

To help you get started, take a moment to glance over this credit score rankings infographic:

THE CREDIT SCORE RANKINGS INFOGRAPHIC

As you can see by the credit score rankings infographic above, credit score rankings generally fall into four groups. While different bureaus and lenders may view these ranges slightly differently, these are some good guidelines for FICO scores and many other measures:

- Poor Credit: If you’re credit score falls below about 630, you may have a harder time finding an apartment. Utility companies may want larger deposits, and insurance companies may even charge you more. Any credit card offers you get are bound to come with high interest rates and unfavorable terms. The sad fact is that you pay more for many things when you struggle with credit problems.

- Fair or Average Credit: You’ll have an easier time getting a credit card, apartment lease, insurance, and utilities if you have fair credit than if you have poor credit. At the same time, you’re still likely to be cut off from the best opportunities. Scores over 630 but below 690 are considered fair or average by most lenders.

- Good Credit: You should be able to land a decent credit card and please insurers, utility companies, and apartments. However, you should still work to improve your credit in order to take advantage of the best offers. Lenders usually consider credit scores between 690 and about 719 as good, though some just consider them average.

- Excellent Credit:Earning a credit score of 720 or above can open lots of doors for you. The better job that you do managing your credit, the more lenders and even some other kinds of companies will want you as a customer, so they’ll make you better offers.

Start Improving Your Credit Rankings Fast

There are many steps you can take to help improve your credit ranking. The first three steps to consider include:

- Order a free copy of your credit report to check it for errors. Simple issues, like duplicated entries, are more common than you might think and fairly easy to correct.

- Commit to making payments on time because late payments can sink your credit fast and keep it sunk if you don’t change your ways. If you can’t pay on time, contact your creditors and see if they will work with you.

- Make a plan to start reducing your debt, which in turn will eventually lower your payments and interest charges. If you want to move your credit from fair to good or good to excellent, using a smaller percentage of your available revolving credit is a good start.

Note that all types of credit won’t impact your credit rankings the same way. For secured credit, like mortgages and auto loans, lenders generally just check to see if you’re making minimum payments on time. If you have a little extra money, you’ll probably help your credit scores more if you put it towards credit cards and other unsecured debt. For more information, refer to our previous article about the kinds of debt you should pay off first to improve your credit.

Does Paying Bills on Time Always Help Improve Credit Ranks?

Paying bills on time is one of the best things that you can do to make sure that you don’t suffer from a poor credit rank. That one good habit is very likely to keep you out of the lower ranges of scores. However, it may not be enough to give you very good or excellent credit scores.

If you’ve already maintain good habits for prompt payments, your next step should be reducing your balances. Lenders like to see that you have only used a portion of all of your available credit. If revolving credit balances are all close to the maximum, lenders will view that as a source of potential trouble in the future. Of course, you’re also stuck with interest payments for all of the credit you’ve already used.

A good place to start might be to reduce credit card balances to more than 25 percent to half of available credit lines.That way, you’ve got credit in reserve to keep for emergencies or other unexpected uses. You also won’t have to waste money on paying extra interest or fees. Note that even if you can entire payoff some of your balances, most financial experts say to keep the credit cards open. If you close the cards, it will reduce your entire available balance and make your ratios worse.

Resources to Help You Improve Your Credit Ranking

Here are some good resources that can help you improve your credit:

- Here is a free credit card payoff calculator that can help you figure out how much extra payments will help you reduce your balances.

- This page on RemediesfortheRestofUs.com has a selection of free budgeting worksheets that you can download to help you find the extra money you need to reduce your debt.

Pingback: 3 “Hidden” Things You Should Know to Boost Credit Scores | Remedies for the Rest of Us