You might automatically think that options trading carries too much risk for a typical investor. If so, you should learn about a relatively low-risk options trading strategy called covered calls. Done right, selling covered calls can work very well with safe-haven stocks to produce income and reduce risks.

The Frugal Pig does not provide investment advice; however, prudent purchases of stocks held over years can provide better returns than the fraction of a percent paid by most bank savings accounts and with fairly low risk. Adding covered calls to the risk can help defray costs, increase income, mitigate risks, and make trading a bit more interesting.

Are Covered Calls a Risky Investment Options Strategy?

Even though covered calls are considered a low-risk investment strategy, they aren’t entirely devoid of risks. The next section, explains how covered calls work, and it should make the potential risks and opportunities easier to understand.

In a nutshell, the main risks involved in covered calls include:

- Having to sell a stock at the strike price because you’ve already accepted payment in return for agreeing to do so. In some cases, the stock could go higher, so you’re paying an opportunity cost. On the other hand, you still get paid for your stock, plus you’ve been paid for the option.

- As with any other stock, the value could decrease. Covered calls won’t protect you against a decreased price. At the same time, you can look at them as a way to reduce your overall costs to mitigate risks.

- Pay attention to broker’s fees. Sometimes these fees can be so high they’ll negate potential profits, so shop around for brokers as well as good opportunities.

Obviously, successfully trading options takes some skill. Prospective traders might start with this glossary of options trading terms. After learning the lingo, it’s time to research options trading strategies.

How Do Covered Calls Work?

Typically, you’ll find option contracts for blocks of 100 shares, so you need at least 100 shares of your stock to participate in covered calls. The fact you own the stock means they’re covered, so that’s where that part of the name comes from.

Besides owning the stock, this is how a covered call works:

- You sell a covered call to a buyer for a specified premium that you will receive immediately. The option will contain an expiration date and a strike price.

- The price of the stock would have to exceed the strike price to motivate the buyer to exercise the “option” to buy. The buyer’s better the stock will exceed the strike price, and you’re betting it won’t.

- If the option expires, the agreement has ended. Note that even if the stock’s price did increase over the strike price, the buyer doesn’t have to buy. Either way, you still get to keep the premium.

To clarify how covered call options work, consider an example of ABC (fictional) stock that’s worth $10 a share. You own 100 shares, worth $1,000. You sell a covered call option for 1.00 a share, or $100, and this option expires in two weeks and has a strike price of $15.

Covered Call Option Example Outcomes

In this covered call example, these are possible outcomes on the expiration date:

- The stock’s worth $15.60, so the buyer exercises the option. You get $1,500 ($15 * 100), plus you keep the $100 premium. Sure, you could have made a bit more selling the stock for $1,560, but you still get to keep the premium.

- The stock’s worth $12.00, and the option expires. You still keep your $100.

- The stock’s value decreased to $9.00 per share, but you still get to keep the $100. That might ease the pain of having your stock drops in value. That’s the thing about stocks; they don’t just increase.

- The stock’s value increased to $16.00 a share, but for some reason, the buyer did not exercise the stock option. Perhaps, the buyer found another opportunity or was short of cash that day. Either way, you still keep the premium.

To see some real-world examples of covered call options on stocks, look at this chart for KMI options on BarChart.com. The chart shows the potential return, and what that return would look like if it was an annual return. In other words, option sellers tend to constantly look for opportunities to enter into a new covered call after old ones have expired.

If they want to hold their stocks, they look for opportunities they don’t believe will get realized by the expiration dates. Of course, there’s always a risk that the stock price will meet the strike price; however, they’re still gaining from selling stocks and earning the covered call premium.

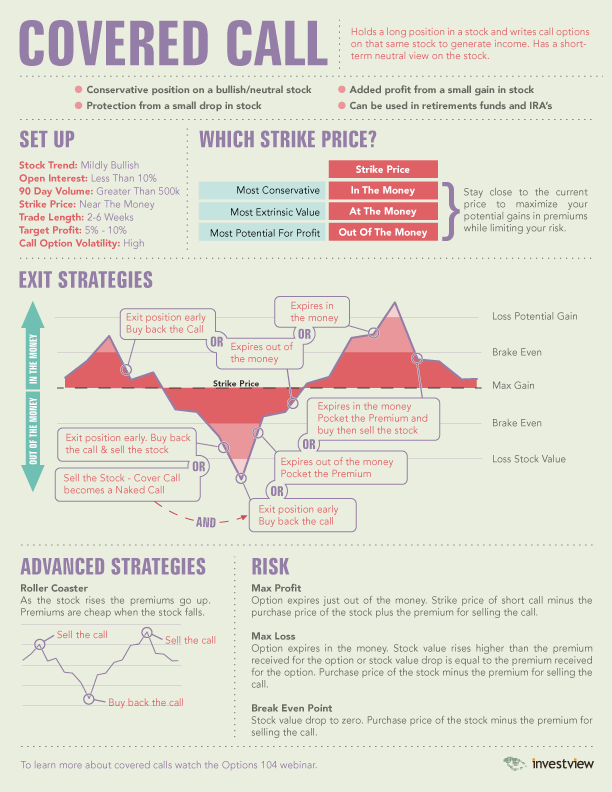

Covered Calls Explained With an Infographic

This is a handy infographic from InvestView to help explain the topic in more depth:

Should You Try Selling Covered Calls as an Options Trading Strategy?

Investing in the stock market always carries risks. People should do their own research, understand their risk tolerance, and never impulsively gamble, especially more money than they can comfortably afford to lose. At the same time, it’s possible to find low-risk stocks and exercise low-risk options strategy, like covered calls, to maximize profits and reduce the chance of losing money.

You might also have an interest in learning about the pros and cons of so-called safe haven investments here: https://frugalpig.com/where-to-find-a-small-investor-safe-haven-during-covid-19/