Outlook for Silver Prices for 2020

Silver has long been referred to as the poor man’s gold. It gets this title because it’s cheaper per ounce than gold and also, price changes in one tend to reflect prices changes in the other one. If you’re interested in adding a precious metal to your portfolio, consider some factors that may impact the silver price outlook for 2020.

Outlook for 2020 Silver Prices

Why do investors buy silver or any other precious metal. In general, they consider silver more as a type of portfolio insurance than as a speculative buy, though of course, some people speculate on precious metal prices. If you look back, silver prices tend to increase during times or uncertainty or weaknesses in such other markets as currency, stocks, and real estate prices.

Over time, while the actual price of silver tends to be fairly volatile, the long-term value of silver mostly levels out to be the same. For instance:

- A recent gas price was about $2.19 a gallon. In 1915, a gallon of gas cost about .15.

- In 1915, a silver dollar contained about .72 ounces. With silver floating around $17.00 an ounce today, that same silver dollar might be worth about $12.

- So, based on silver alone, your silver dollar would buy about six gallons of gas today or in 1915.

Silver Isn’t Just for Investments

In order to predict the true silver price outlook for 2020, it’s important to note that about 60 percent of silver demand is for industrial use. This includes autos, solar power, electronics, jewelry, and silverware.

The rest is for coins and bars kept by investors. This is greater than the production use for gold and other precious metals. That’s why some precious metal analysts think that silver should be considered as more of a strategic metal than gold, platinum, and other precious metals.

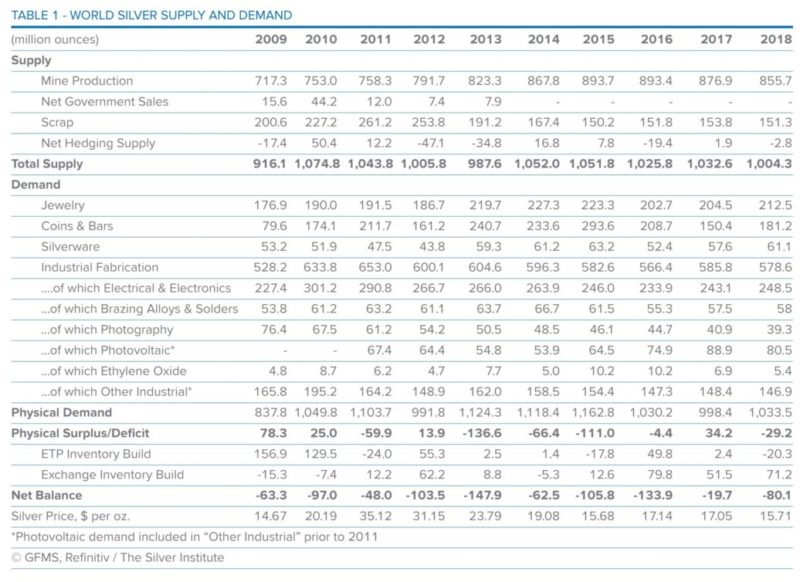

The other thing to note is that production and investment demand for silver has exceeded supply for the last decade, according to charts from The Silver Institute. You can look at the charts for yourself to understand how silver gets used for many different kinds of industries and to make silver and even silverware.

Silver Institute: Global Silver Supply and Demand From 2009 to 2018

Note that in 2018, the demand for this precious metal exceeded 1033 million ounces; however, the supply was only about 1004 million. This trend of demand exceeding supply has remained consistent over the last decade. Even though, for instance, digital photography has reduced the demand for silver for film, the boom in demand for silver for PV solar cells has more than made up for it.

What Do Silver Analysts Predict for Silver Prices in 2020?

First, note that silver price does not directly correlate to supply and demand. Really, investors tend to set prices based upon their sentiments about both the silver market and other markets. Historical sharp increases or decreases in silver prices tend to correlate better with uncertainty or current economic or political issues than with production use. During the Great Recession silver prices rose, but as is true during economic downturns, production of some goods that require silver may have dropped.

Investing News reported upon one silver CEO’s prediction for $120 an ounce in the near future. While it’s important to understand that this was much higher than other predictions and probably a bit optimistic, even more conservative analysts believe 2020 should see at least around $20 an ounce or remain fairly firm.

One other major factor that can play into silver price increases is the recent interest rate drop. When interest rates decrease, investors have more incentive to put their money in precious metals that they believe are priced fairly or even somewhat undervalued.

Should You Buy Silver Now?

Again, most investors don’t use silver to speculate. They use it to provide insurance against economic uncertainty and downturns. Typical investors may allocate 10 to 20 percent of their portfolio towards precious metals and not their entire savings.

Still, if you plan to add a precious metal to your portfolio, you might consider silver. The production use for silver provides a floor — so what you buy should hold value. You probably shouldn’t ever consider precious metals as a way to get rich quick; however, you can think about them as a way to protect the value of some savings.

Note: This is NOT investment advice. It’s an informative look at the demand and supply for silver and the possible 2020 silver price outlook. You should always do your own research to make sound choices with your money.

1 thought on “Silver Price Outlook for 2020”