Small Business Credit Card Balance Transfer Tactics

Note: We may embed some sponsored links that can earn us a commission to defray operating costs for this website.

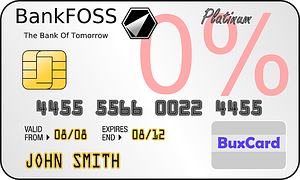

Note: We may embed some sponsored links that can earn us a commission to defray operating costs for this website. Small businesses benefit from effective credit management. You might consider using credit card balance transfers as one tactic to better manage business credit. This really only works if your company can maintain decent credit; at the same time, these tactics can help you save money and improve your overall business credit scores. The idea is to use business credit cards with low or even 0-percent introductory offers to your advantage, and of course, to keep using them!

An Introduction to Business Credit Card Transfer Tactics for Small Business

Transferring personal debt to a business credit card: If you are like a sizable portion of new business owners, you have used some personal debt to get your company off the ground. It’s pretty simple to transfer a balance from a personal credit card to a business card. If you qualify for a card in your business name, you can usually get some checks that can be used with this card. Simply write a check from the new card to transfer the balance from the old, personal card. That way, you can start to establish even better credit in your company’s name and stop having to risk your personal credit scores.

Business Credit Card Transfers With 0% Introductory Rates

It’s easy to find finance companies with introductory APRs that may last from 12 to 18 months. That is, these offers are easy to find if your credit is decent. If not, you might have to consider ways to improve your overall credit score, but that’s another topic. Otherwise, this process is effective and pretty easy to understand:

- Pay the minimum: Simply pay the minimum payment on the card during your introductory-rate period. You can help to improve your company’s cash management. Your savings could go towards working capital management, growth, or simply establishing an emergency fund.

- Have a way to pay the balance before the introductory period ends: Make certain you have a new card with a new introductory offer before the first card’s introductory period term ends. At that point, you simply use checks from the new card to transfer the old card’s balance. Some savvy businesspeople rely upon this method of saving money on interest for years.

- Decide if you should close the old account: At the point you’ve paid off the old card, you’ll want to decide if you should close the account or not. You won’t close the card by just paying off the balance. You might decide to keep it in reserve or just get rid of the temptation. In some cases, a paid balance will trigger a new intro offer from the old company, so you might want to see what happens.

Use balance transfers wisely: Certainly, there are pitfalls to this strategy if you don’t handle it correctly. First, many of the business cards with great perks and intro offers also carry high APRs once the period ends. Some cards also come with high fees that are separate from mere interest charges. You need to shop around for a competitive offer and make sure you can get the balance paid off in time.

If not, you could join the ranks of business owners who feel a burden of debt. After all, these business card issuers know what they are doing, and they don’t offer low rates to lose money. They count on the fact that many of their customers won’t be able to pay off the balance in time.

What if You Can’t Pay the Balance Before the Introductory Rate Ends?

If you suspect that you won’t be able to pay off your credit card balance before your card issuer starts hitting you with high interest rate, you probably should consider another method of obtaining financing or pay more than the minimum payment. As you probably already know, card companies set minimum payments to keep their customers with balances and interest charges for as long as they can. Nobody should only count on making minimum payments if they don’t have a good payoff strategy.

What to Look for in Business Credit Cards With 0% APR Introductory Offers

Some cards may charge high yearly fees, so that could factor into your choice to keep a card or not. Businesses may find the card perks valuable. For example, some finance companies offer things like airline miles, access to VIP lounges, or discounts with partners. If these perks help your company, they might balance out fees; if they’re not useful, you might be better off with a card with lower fees and fewer rewards.

These are some basic tips to shop for business credit cards:

- Be aware of fees and the APR after the introductory period ends.

- Consider your credit management strategy.

- Decide of reward programs and other perks offer your business value.

These days, it’s pretty easy to shop around for the best credit card offers for your small business. You can usually also apply online and even get an instant approval. Learn about each card you consider, so you understand what kind of credit they are looking for. While you can enjoy some benefits of managing business credit cards well, you also don’t want to get a lot of applications and declines on your credit report.

Pingback: Alternative Loans for Small Business | Frugal Pig